Curve is an e-money service that lets you load all your credit or debit cards into one app! They currently offer their services to personal customers & businesses within the UK and Europe.

These perks, which range from attractive cashback features to changing the underlying payment card after the fact, make Curve an excellent option for those who need to use different cards at once like when they’re overseas.. However, for those who already have a good grip on their finances and manage their budgets well, the usefulness of Curve diminishes.

The app keeps track of card spending and also shows insights about a user’s spending habits. It lets you send money to others with the card. Other features include going back in time, cashback and Curve Fronted to name a few.

Curve launched its BETA back in 2016 with two tiers, Curve Blue and Curve Back the latter costing a one-off £50 fee which offered double cashback in Curve Rewards. Since then, Curve has moved to a subscription model at the start of 2019 and offers 3 tier options, Curve Blue, Curve Black and Curve Metal which we will take a deeper look later in this review.

How does Curve work?

Curve allows you to spend from any of your accounts using just one card, you can save a lot of time and effort by clearing out the clutter from your wallet and organizing your finances. Add your eligible Visa, Mastercard, Diners or Discover debit and credit cards to the Curve app. There’s no money stored in your Curve account, Curve can’t be used to store money directly. You just select the account that you’d like to pay with, by opening the Curve app and tapping on the desired payment card- that account will then become “active” and ready for use. This card remains active untill you change it.

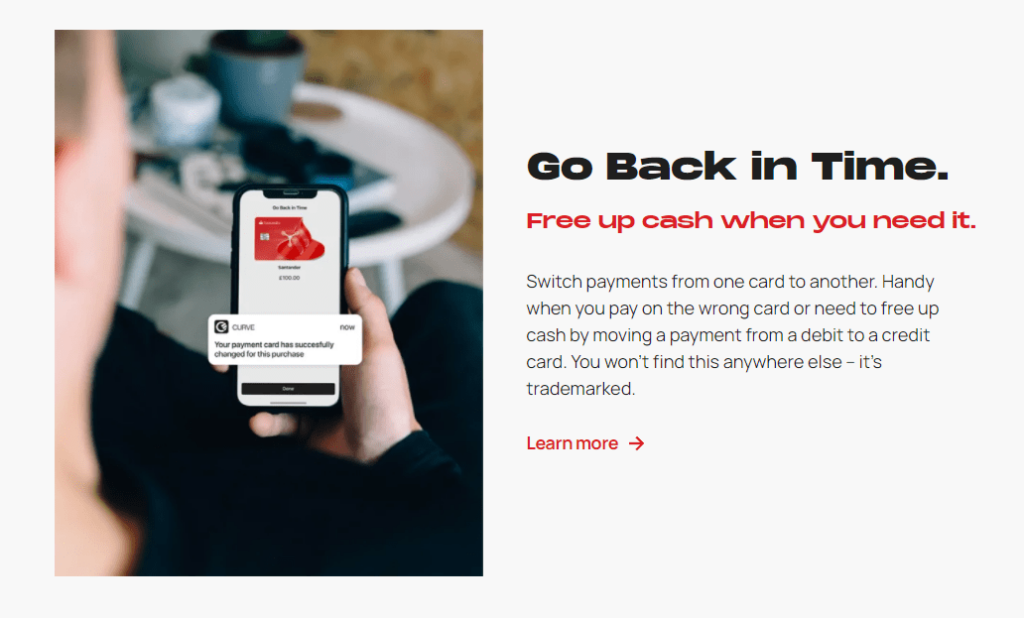

Go back in time

Curve has a number of features to make your life easier. Starting off with ‘Go Back In Time’ this is an amazing feature for those of us who forget to change the underlying payment card when using Curve. This is great to have and one of the biggest USP’s for Curve. Here are a couple of scenarios where we have used this feature in the past.

Scenario 1 – Where we had a business payment go through on to my personal card. We used the go back in time feature to change the underlying card from a personal Credit card to a business bank account.

Scenario 2 – It is getting close to the end of the month, and I needed to free up some cash to pay for some upcoming Direct Debits due to go out the following week to avoid going into my overdraft. So again, i used the go back in time feature to change the underlying payment card from my current account to a credit card. This is also handy if you want to switch them to get your cashback or air miles from your credit card provider.

There are some limitations to this feature. Go Back In Time can only be used within 30 days of the payment first taking place and not exceeding the amount of £5,000 per transaction and can only be used once per transaction.

Curve Fronted

Is an innovative feature that allows you to pay a UK tax bill or a credit card bill with a credit card. To use this feature, there is a 1.5% fee for Curve Blue and Curve Black users and it’s free for Curve Metal.

Anti-Embarrassment Mode

Just turn it on, and you’ll never again have to worry about declines. If your card doesn’t work, it will try your backup cards automatically. Super simple concept but can save you a lot of embarrassment when at the checkout. Your card could be declined for a number of reasons, from not having available funds to unusual activity flagged on your account by your bank.

Can I Use Curve Abroad?

Curve is a great travel companion, it’s the primary reason I signed up to the platform during its Beta. Curve allows you to use any of your registered cards abroad, it will handle the FX conversions with competitive rates so you don’t have to worry about those nasty transaction fees and poor exchange rates given by your bank. However, its worth noting there is a weekend FX fee.

Are there any spending limits?

in short, there are limits set by Curve to ensure the platform is being used responsibly.

When you join Curve, your standard Curve spending limits are:

- £2,000 spend per day

- £5,000 spend per month (rolling 30 days)

- £200 cash withdrawal per day

- £10,000 yearly (rolling 365 days)

These are the limits when you join the platform, but this isn’t set in stone. As you build up your activity and usage, these limits can be increased by sending them a message.

Is it safe?

Curve is authorised to by the Financial Conduct Authority (FCA) in the UK. Your personal data will be safe, and Curve does not share your bank details to the merchant. if you lose your card, you can instantly disable the use of the card by freezing it within the app and request a replacement.

Am I protected under section 75?

The short answer is no.

You do not benefit from the same protection as a credit card. Curve acts like a middle man similar to when you use PayPal or Amazon, 3rd party purchases.

However, they have recently added Curve Customer Protection.

Conclusion

I’ve been using Curve since 2016 and it’s been part of my everyday life with making payments for small things like the usual coffee to work, meals at restaurants and all payments when abroad. I use Curve for everything except for anything I know I want section 75 protection like booking flights and other large purchases.

Curve provides a ton of features to help you with managing your money better, with powerful insights detailing where your money is being spent between cards. Helping you remember those business purchases, but also useful ones like go back in time when you need to free up cash.

Responses (0 )